Highlighting Your Tax Accountant Skills

A compelling cover letter is your first opportunity to impress a potential employer as a tax accountant. This document is a crucial tool that complements your resume, providing a platform to showcase your skills, experience, and enthusiasm for the role. To get hired fast, your cover letter should be a concise, well-written piece that highlights your most relevant qualifications. It’s not just about listing your past jobs; it’s about demonstrating how your specific skills and experiences align with the job requirements and how you can contribute to the company’s success. Remember, a great cover letter goes beyond simply repeating what’s in your resume; it offers a narrative, a story of your career and aspirations.

Expertise in Tax Law and Regulations

Your cover letter must immediately convey your deep understanding of tax laws and regulations. Specify the jurisdictions you’re familiar with, such as federal, state, or international tax codes. Showcase your knowledge of complex areas like corporate tax, individual income tax, or estate tax, depending on the job requirements. Mention any certifications, such as a Certified Public Accountant (CPA) or Enrolled Agent (EA), to establish your credibility and expertise. Provide examples of how you’ve successfully applied this knowledge to minimize tax liabilities, ensure compliance, or resolve complex tax issues for clients. These details prove you’re not just familiar with tax laws but can also apply them effectively, a crucial skill for any tax accountant.

Demonstrating Proficiency with Tax Software

Tax accounting in the modern era relies heavily on software, so your cover letter should highlight your proficiency with relevant tools. List the specific tax software packages you’re experienced with, such as: ProSeries, TurboTax, Lacerte, or others commonly used in the industry. If you’re familiar with cloud-based platforms or specific accounting systems, be sure to mention those as well. Provide concrete examples of how you’ve utilized this software in the past to improve efficiency, reduce errors, or enhance the quality of tax returns. This demonstrates your ability to seamlessly integrate into a team, reduce onboarding time, and immediately contribute to the company’s workflow. Moreover, it shows that you’re up-to-date with the technological demands of the tax profession.

Quantifying Your Achievements

To make your cover letter stand out, focus on quantifying your accomplishments. Instead of simply stating your responsibilities, use metrics to demonstrate the impact you’ve made in previous roles. For example, mention how you’ve ‘reduced tax liabilities by X%,’ ‘processed Y number of tax returns accurately,’ or ‘identified Z dollars in tax savings for clients.’ Use numbers, percentages, or specific figures to highlight your successes. These quantifiable results make your accomplishments more tangible and demonstrate your ability to deliver real value. Including such details will make your cover letter significantly more persuasive and show your potential employer the concrete benefits of hiring you.

Formatting Your Tax Accountant Cover Letter

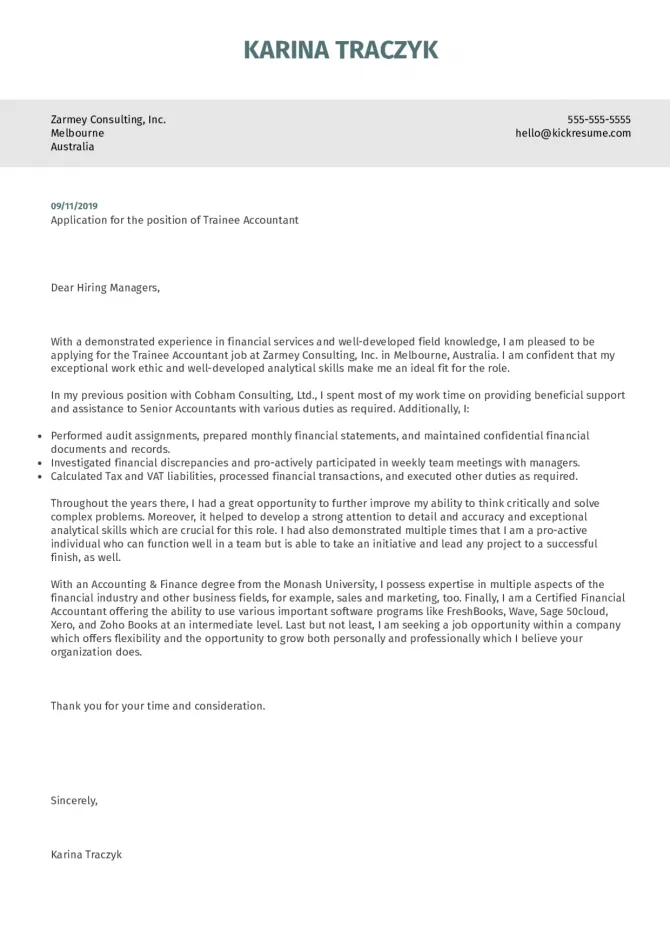

Contact Information and Salutation

Start your cover letter by including your full name, contact information (phone number, email address, and LinkedIn profile, if applicable), and the date. Then, address the hiring manager by name, if possible. Research the company to identify the correct person to address your letter to. Use a professional salutation, such as ‘Dear Mr./Ms. [Last Name]’. If you can’t find a specific name, a general greeting like ‘Dear Hiring Manager’ is acceptable. Accurate and professional contact information and a personalized salutation demonstrate attention to detail and initiative, both important qualities for a tax accountant.

Body Paragraphs Strategy

Structure your cover letter with clear, concise paragraphs. The first paragraph should state the position you’re applying for and how you learned about the opportunity. In the subsequent paragraphs, elaborate on your skills, experience, and achievements, using the STAR method (Situation, Task, Action, Result) to describe your accomplishments. The STAR method helps you provide specific examples of how you’ve handled challenges and achieved results. Keep your paragraphs focused, avoiding jargon and being direct in your communication. Each paragraph should contribute to the overall narrative, demonstrating why you are the best fit for the role. Aim for a balance between showcasing your expertise and demonstrating your personality.

Closing and Call to Action

In the closing paragraph, summarize your interest in the position and reiterate your enthusiasm. Include a call to action, such as ‘I am eager to discuss my qualifications further in an interview’ or ‘I look forward to the opportunity to contribute to your team.’ Express your appreciation for the reader’s time and consideration, and use a professional closing, such as ‘Sincerely’ or ‘Respectfully,’ followed by your name. A strong closing reinforces your interest and makes it easier for the hiring manager to take the next step, ultimately increasing your chances of being called for an interview.

Tailoring Your Cover Letter

Researching the Company

Before you write, take the time to research the company you’re applying to. Visit their website, read their mission statement, and understand their values and culture. Look at their recent news, projects, or industry contributions. Tailor your cover letter to reflect your understanding of the company’s needs and objectives. Demonstrate how your skills and experience align with their specific requirements. Mentioning specific company projects or values shows that you’ve put in the effort to understand the organization, making a positive impression. By demonstrating your knowledge of the company, you show genuine interest, making your application more appealing.

Matching Skills to Job Requirements

Carefully review the job description and identify the key skills and qualifications the employer is looking for. Then, match your skills and experience to those requirements in your cover letter. Don’t just list your qualifications; explain how your skills align with the specific needs of the job. Use keywords from the job description to make your cover letter easily searchable by Applicant Tracking Systems (ATS). By highlighting the most relevant skills, you demonstrate your ability to meet the company’s expectations and increase your chances of being selected for an interview. Customizing your letter in this manner demonstrates that you are a good fit and shows you’ve paid attention to the details.

Proofreading and Editing

Proofread your cover letter meticulously. Check for grammatical errors, spelling mistakes, and typos. A well-written, error-free cover letter demonstrates your attention to detail and professionalism. Consider having someone else review your letter to catch any mistakes you might have missed. A second pair of eyes can provide valuable feedback and help you refine your writing. Ensure the tone is professional and your letter is easy to read. A polished and error-free cover letter makes a positive first impression and showcases your commitment to excellence.

In conclusion, crafting a compelling cover letter as a tax accountant is crucial to getting hired. By showcasing your skills in tax law, proficiency in tax software, and ability to quantify achievements, you can make a strong impression. Remember to format your letter professionally, tailor it to each specific job, and proofread it carefully. With these strategies, you’ll be well-equipped to get noticed and land your dream job.