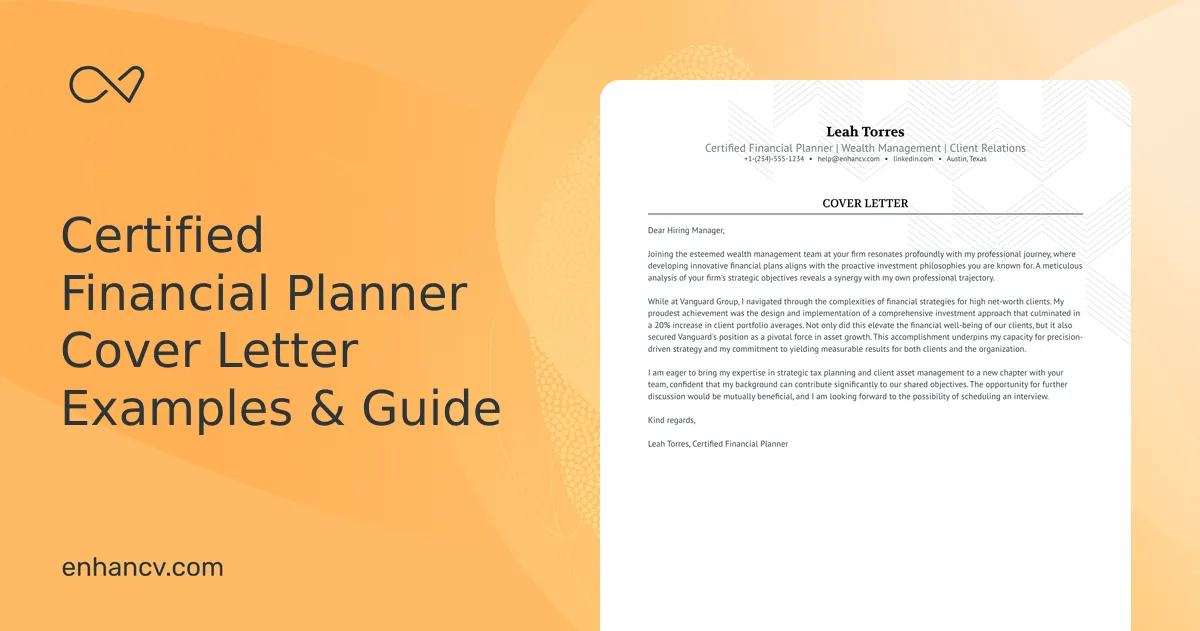

What is a Financial Planner Cover Letter

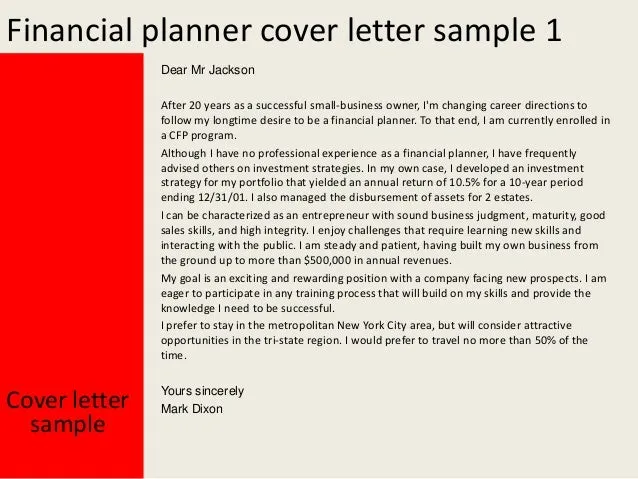

A financial planner cover letter is a crucial document that accompanies your resume when applying for positions within the financial planning industry. It serves as a personalized introduction, allowing you to highlight your skills, experience, and passion for financial planning. Unlike a resume, which provides a summary of your qualifications, a cover letter enables you to elaborate on specific achievements and explain why you are the ideal candidate for a particular role. It’s your chance to make a strong first impression and demonstrate your understanding of the company and the position you’re applying for. A well-crafted cover letter can significantly increase your chances of getting an interview and ultimately landing your dream job as a financial planner.

Purpose of a Financial Planner Cover Letter

The primary purpose of a financial planner cover letter is to introduce yourself and express your interest in a specific financial planning position. It allows you to showcase your unique qualifications and explain how your skills align with the requirements of the role. Furthermore, a cover letter provides an opportunity to demonstrate your knowledge of the company and its values. By tailoring your letter to each job application, you can highlight your understanding of the company’s mission and how you can contribute to its success. A well-written cover letter can set you apart from other applicants by demonstrating your professionalism, attention to detail, and genuine interest in the position. It’s a chance to make a compelling case for why you deserve an interview.

Why is a Cover Letter Important

In today’s competitive job market, a cover letter is more important than ever. It provides context to your resume, allowing you to explain your career trajectory and highlight your most relevant experiences. A cover letter demonstrates your communication skills and your ability to articulate your value proposition. It shows that you’ve taken the time to research the company and the role, indicating your genuine interest. Without a cover letter, your application may seem generic and impersonal. A cover letter also helps you address any potential concerns or gaps in your resume, such as a career change or a period of unemployment. By using a cover letter, you can control the narrative and present yourself in the best possible light.

Top 5 Tips for a Financial Planner Cover Letter

Highlight Your Relevant Skills and Experience

When writing your financial planner cover letter, it’s crucial to highlight the skills and experience that are most relevant to the job you’re applying for. Review the job description carefully and identify the key qualifications the employer is seeking. Then, in your cover letter, provide specific examples of how your skills and experience align with those requirements. For instance, if the job description emphasizes experience in retirement planning, describe your previous work in this area, including any successful outcomes. If the position requires strong communication skills, provide examples of how you have effectively communicated complex financial information to clients or colleagues. Tailor your cover letter to each job application to emphasize the qualifications that are most important to the employer.

Quantify Your Achievements

Instead of simply listing your responsibilities, quantify your achievements whenever possible. Use numbers and data to demonstrate the impact you’ve had in previous roles. For example, rather than saying you managed a portfolio of clients, state that you managed a portfolio of 50 clients with a combined asset value of $10 million, consistently exceeding performance benchmarks by 10%. Quantifying your achievements provides concrete evidence of your capabilities and makes your cover letter more persuasive. It allows the employer to see the tangible results you’ve produced and understand the value you can bring to their organization. When describing your accomplishments, use action verbs and focus on the positive outcomes of your work.

Tailor Your Letter to the Job Description

Avoid using a generic cover letter for every job application. Take the time to tailor each letter to the specific job description and the company. Research the company and understand its values, mission, and the specific requirements of the role. Then, in your cover letter, address how your skills and experience align with those requirements. Show the employer that you understand their needs and that you are a good fit for their organization. This may involve changing the language you use, emphasizing different aspects of your experience, or including specific examples that are relevant to the job. Tailoring your cover letter demonstrates your attention to detail and your genuine interest in the position, increasing your chances of getting an interview.

Showcase Your Personality and Passion

While professionalism is essential, don’t be afraid to let your personality shine through in your cover letter. Use a professional but friendly tone that reflects your enthusiasm for financial planning. Share your passion for helping clients achieve their financial goals and demonstrate your commitment to the industry. This could involve mentioning specific aspects of financial planning that you find particularly rewarding or sharing your long-term career aspirations. Showing your personality can help you make a more memorable impression on the hiring manager and make your cover letter more engaging. However, be sure to maintain a professional tone and avoid anything that could be perceived as unprofessional or inappropriate.

Proofread and Edit Carefully

Before submitting your financial planner cover letter, carefully proofread and edit it to ensure that it is free of any errors. Typos, grammatical errors, and spelling mistakes can create a negative impression and undermine your credibility. Check for consistency in your formatting, font, and tone. Read your cover letter aloud to catch any awkward phrasing or unclear sentences. It’s also a good idea to have a friend or colleague review your cover letter for any errors you may have missed. Pay close attention to the details, as a polished and error-free cover letter demonstrates your attention to detail and professionalism. A well-proofread cover letter shows that you care about the quality of your work and that you are committed to excellence.

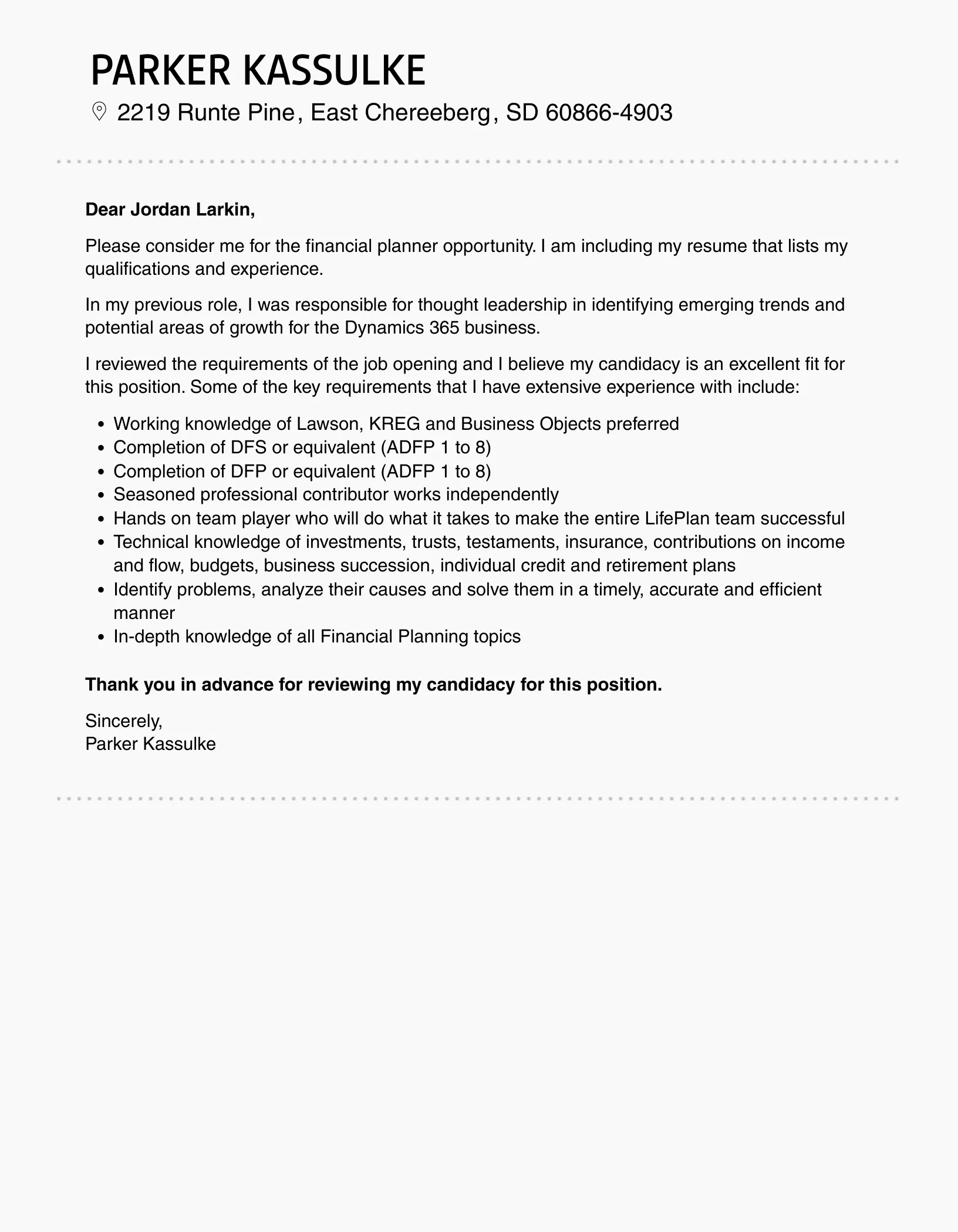

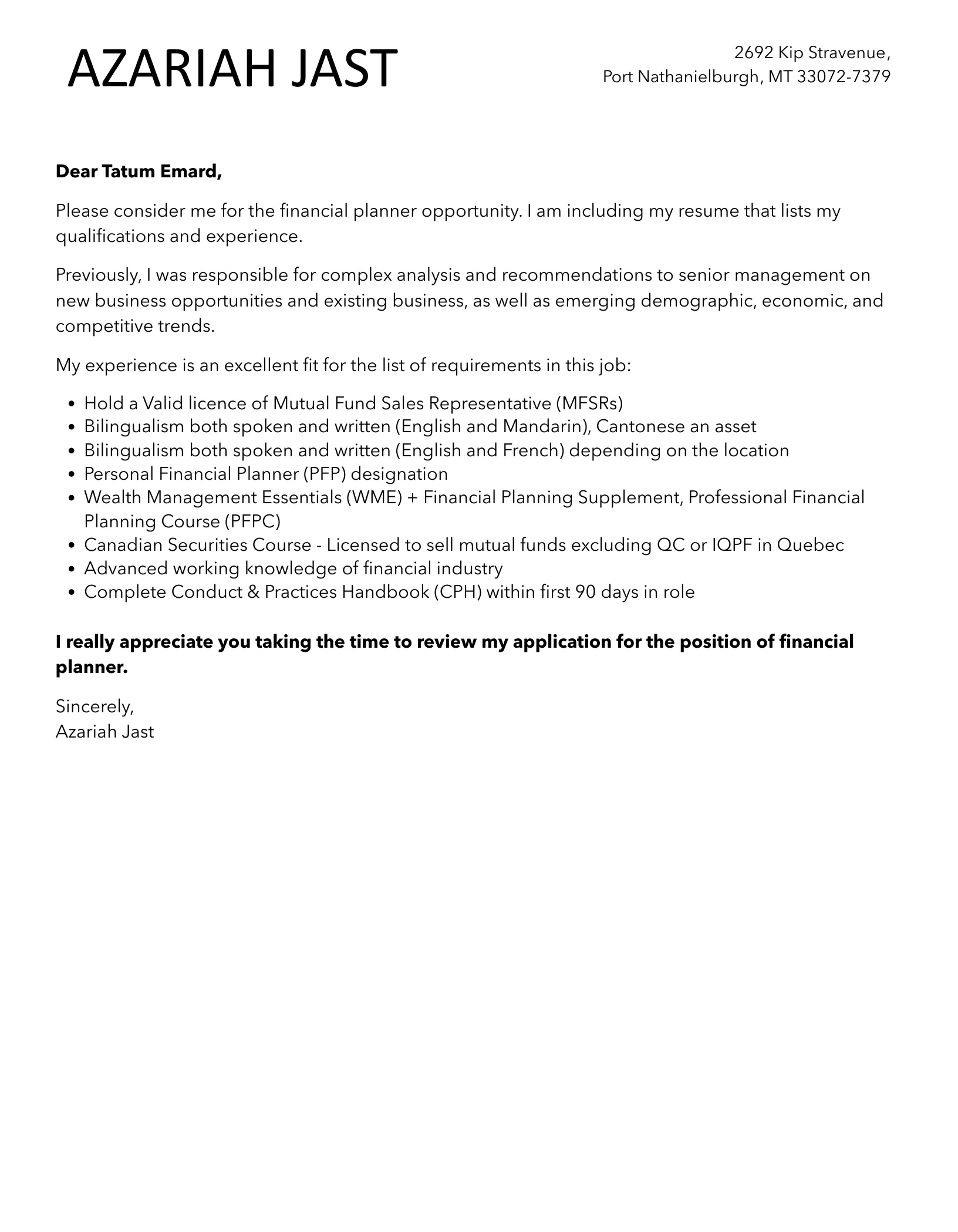

Key Sections to Include in Your Cover Letter

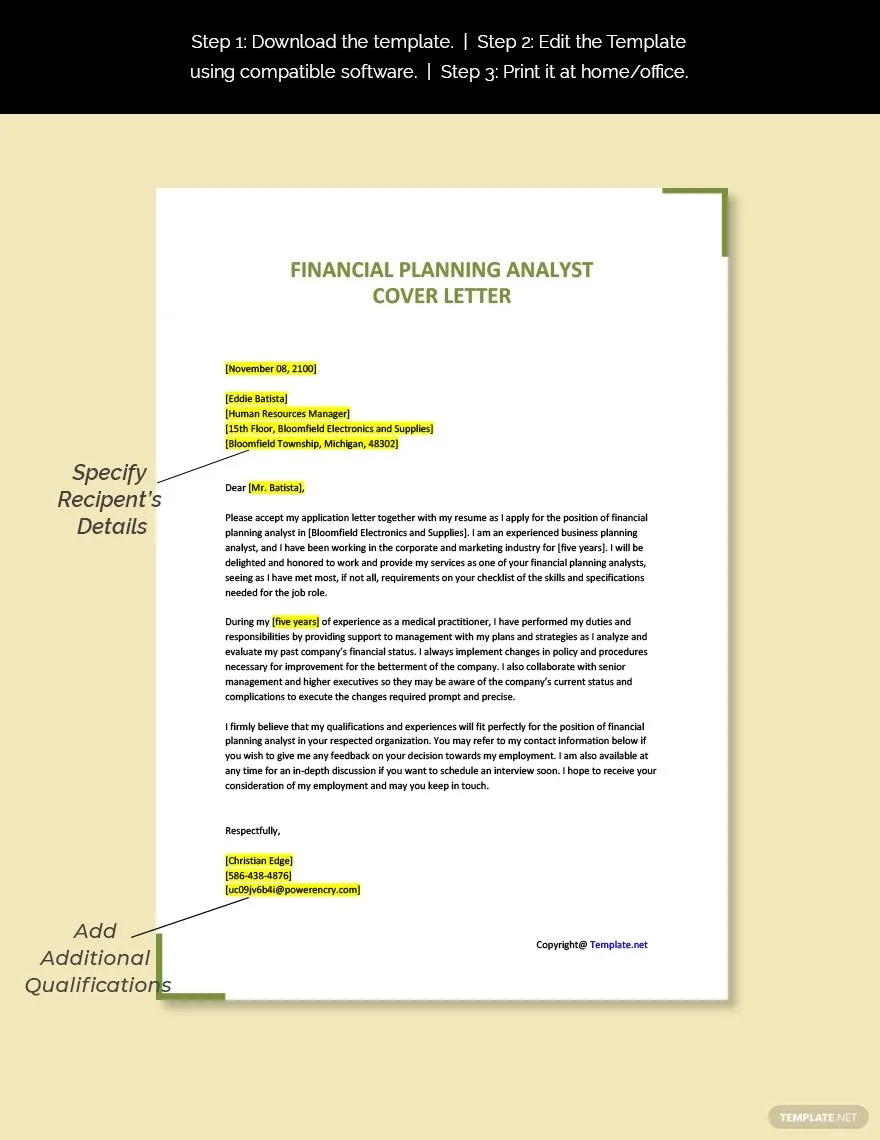

Contact Information and Salutation

Start your cover letter by including your contact information at the top, including your name, phone number, email address, and LinkedIn profile URL. Then, address your letter to the hiring manager by name if possible. If you don’t know the hiring manager’s name, use a general salutation like “Dear Hiring Manager.” Addressing your letter to a specific person shows that you’ve done your research and that you are serious about the position. Ensure your contact information is accurate and up-to-date, so the employer can easily reach you. A professional salutation sets the right tone from the beginning and shows respect for the recipient.

Opening Paragraph

Your opening paragraph is your chance to grab the reader’s attention and make a strong first impression. Clearly state the position you are applying for and where you found the job posting. Briefly mention why you are interested in the role and the company. Highlight one or two key skills or experiences that make you a strong candidate. Avoid generic openings. Instead, create a compelling opening that sparks the hiring manager’s interest and encourages them to read on. The opening paragraph should be concise and focused, setting the stage for the rest of your cover letter.

Body Paragraphs

The body paragraphs are the heart of your cover letter. Here, you’ll elaborate on your skills, experience, and achievements, providing specific examples to support your claims. Focus on the qualifications most relevant to the job description. Use the STAR method (Situation, Task, Action, Result) to structure your examples and demonstrate your accomplishments. Quantify your achievements whenever possible. Show your understanding of the company’s needs and how you can contribute to its success. Keep your paragraphs concise and focused, using clear and concise language. The body paragraphs should provide a detailed explanation of why you are the best candidate for the position.

Closing Paragraph

In your closing paragraph, reiterate your interest in the position and thank the hiring manager for their time and consideration. Express your enthusiasm for the opportunity to learn more about the role. Include a call to action, such as stating that you are eager to discuss your qualifications further in an interview. Reiterate your contact information. The closing paragraph should be positive, professional, and leave the reader with a favorable impression. The goal is to end the cover letter on a strong note, reinforcing your enthusiasm for the position and encouraging the hiring manager to contact you.

Formatting Your Financial Planner Cover Letter

Font and Font Size

Choose a professional and easy-to-read font, such as Times New Roman, Arial, or Calibri. The font size should be between 10 and 12 points. Ensure that the font is consistent throughout the entire cover letter. Avoid using overly decorative or unusual fonts, as they can be distracting and make your cover letter difficult to read. Choose a font that reflects your professionalism and attention to detail. The goal is to create a visually appealing and easy-to-read document that showcases your qualifications effectively. A clear and professional font enhances the overall impression of your cover letter.

Margins and Spacing

Use standard margins of 1 inch on all sides of your cover letter. Double-space your cover letter for readability. Use single spacing within paragraphs and a blank line between paragraphs. This will make your cover letter easier on the eyes and help the reader quickly scan the content. Proper formatting improves the overall visual appeal of your cover letter and demonstrates your attention to detail. Consistent margins and spacing create a clean and professional appearance, increasing the likelihood that your cover letter will be read and appreciated.

Length of the Cover Letter

Keep your cover letter concise and to the point. Aim for one page in length, unless the job description specifically requests more. Your cover letter should be a summary of your most relevant qualifications and experiences. Avoid including unnecessary details or lengthy explanations. The goal is to capture the reader’s attention quickly and make a strong case for why you are the right candidate. A concise cover letter demonstrates your ability to communicate effectively and respect the hiring manager’s time. Focus on the key information that will convince the reader to learn more about you and review your resume.

Example Cover Letter Snippets

Here are example snippets to use in your financial planner cover letter to give you an idea of what to write. “I am writing to express my keen interest in the Financial Planner position at [Company Name], as advertised on [Platform]. With [Number] years of experience in financial planning, including a proven track record of exceeding client expectations and managing portfolios valued at over $[Amount], I am confident I possess the skills and dedication to excel in this role.” Another example is: “In my previous role at [Previous Company], I developed and implemented financial plans for over [Number] clients, resulting in a [Percentage]% increase in client satisfaction. I have a deep understanding of investment strategies, retirement planning, and estate planning, and I am passionate about helping clients achieve their financial goals.” Tailor these to your experience!

How to close the Financial Planner Cover Letter

Close your financial planner cover letter by reiterating your interest in the position and thanking the hiring manager for their time and consideration. You can state something like, “Thank you for your time and consideration. I am excited about the opportunity to learn more about this Financial Planner position and discuss how my skills and experience align with your company’s needs. I am available for an interview at your earliest convenience.” Follow this up by including your contact information again. Remember to proofread one last time!